We use cookies to give you a better experience on our website. Learn more about how we use cookies and how you can select your preferences.

CathRx – Heart electrophysiology transformed

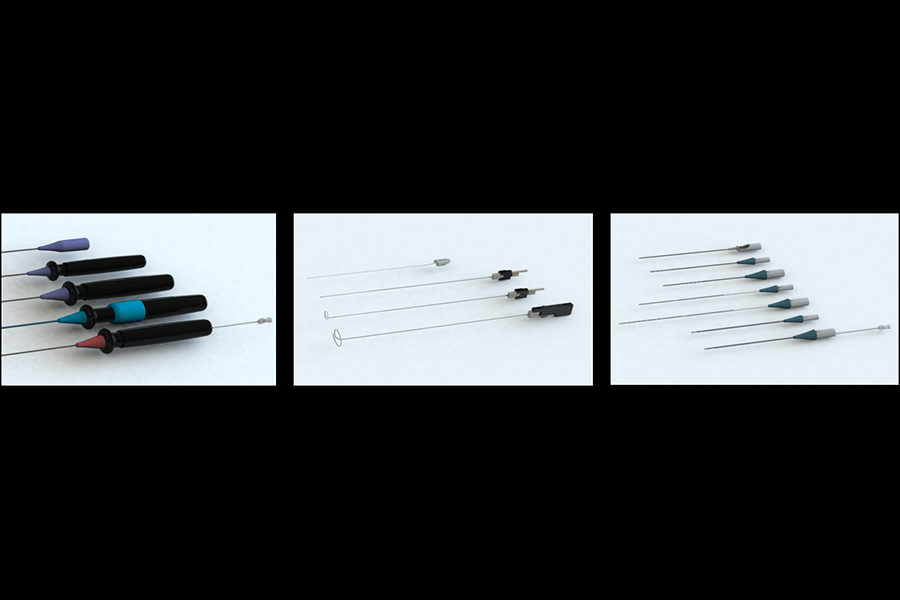

CathRx develops and manufactures low-cost, high-quality medical devices such as these re-usable catheters.

Company Profile

Company: CathRx Ltd

Sector: Medical Device Development

Location: Homebush Bay, Sydney

Profile: CathRx develops and manufactures low-cost, high-quality, modular electrophysiology Khelix™ re-processable catheters. These allow hospitals, health insurance providers and government organisations to reduce the costs, and environmental impacts, of single-use catheters.

Why R&D was needed

Cardiac arrhythmias are heart rhythm disorders that are becoming increasingly common. Cardiac arrhythmias are frequently caused as we age and through our modern lifestyles.

Heart disease causes abnormal or ‘rogue’ electrical pathways in the heart. These cause the heart to beat irregularly or in an uncomfortable way. Irregular heartbeats can damage the heart and is a main cause of stroke.

Treatments for heart disease such as surgery, medication and electrophysiology are expensive. Surgery and medication can cause other risks and side effects.

In electrophysiology, the cardiologist inserts a catheter into the heart chamber to identify and locate the rogue or unwanted pathways. The cardiologist then uses ablation catheters to destroy these pathways. Up to 3 or 4 catheters may be used in a single treatment, each costing up to $1,500.

CathRx’s new range of cost-effective catheters will improve life-saving treatments for cardiac arrhythmias.

According to CEO Ian Fong, CathRx's Khelix range are 50% cheaper and 70% greener than previous catheters. They can also be re-used up to 20 times.

“We have managed to engineer 70% of catheter cost into the re-useable components. Hospitals are able to re-process via their own sterilisation departments,” he said.

Mr Fong believes that the R&DTI is helping Australia becoming a leader in medical innovation, especially for bio-tech devices. He says more investment is needed from the private sector. Instead, large multinational organisations aim to keep prices high in the Australian market.

“It's a bloody shame,” he said.

How the Research and Development Tax Incentive Helps

Mr Fong said CathRx has the R&DTI program to thank for its success.

“Holistically, it has reduced our costs and (therefore) financial losses, and has been instrumental in helping us attract new capital. Not only have we been able to survive, but we can pursue our path of continuous improvement.”

Mr Fong said the R&DTI program has also helped CathRx to do a lot of its R&D on home soil. Without that, CathRx would have had to source cheaper test facilities overseas.

“We now have a full-time staff of 25 with a further 3 or 4 working part-time,” he said.

CathRx partners with universities, research institutes and hospitals to do clinical work in Australian.

“We now have 75% of our range at the point where we are able to commence testing on humans in hospitals.”

CathRx aims to conduct its clinical trials in Australia whenever possible, leading to further local employment.

Thanks to the R&DTI’s assistance in his company’s R&D, Mr Fong now sees his business branching into new areas. Doctors could use his catheters for therapeutic and diagnostic purposes.

CathRx has also discovered another technology that could further reduce medical costs and improve treatments. It is developing a second generation of products.

Aside from the medical benefits, CAthRx is creating other economic benefits in Australia. CathRx sources most of its materials from Australian suppliers and plans to use Australian distributors to transport the product.

“Australia could never compete in the medical device sphere without the R&DTI scheme. Strategically, it means we’ve became more rational and focused, following our R&D directly to meet market demands.

“Our costs were lowered so we could hire more people, yet remain in Australia and still become competitive. And we have definitely developed new skills.”

Mr Fong said that without the R&DTI, his company would only have had half of their R&D budget to work with, putting them under financial strain. The company could have been overtaken by a better-funded overseas company. If they had survived to get their innovation patent, they’d have had to licence it to a multinational.

“Australian innovation and skills are as good as anywhere in the world, but our commercial environment is not conducive to supporting them. Without the R&DTI scheme we'd have nothing.”

For our company alone, [the R&DTI] has enabled us to take our ideas, here in Australia, and develop them into meaningful, life-saving products with a potential world-wide impact.

R&DTI Impact Facts

- About $4,000,000 provided to the company via the program

- Rebated in terms of tax offset at 43.5%

- Enabled collaborations with University of Adelaide, South Australian Hospitals, and St George Hospital

- Helped finance new employees

- Increased company R&D budget by approximately 50%

- R&D tests remain within Australia

- Australian companies supply components needed for product creation

- Potential for reduced supply cost to the health industry and tax payers

- Enabled development of cost-effectives and life-saving medical devices

- Enabled ongoing use of Australian suppliers, distributors, clinical support and research