We use cookies to give you a better experience on our website. Learn more about how we use cookies and how you can select your preferences.

How we monitor R&D Tax Incentive applications

Our integrity framework

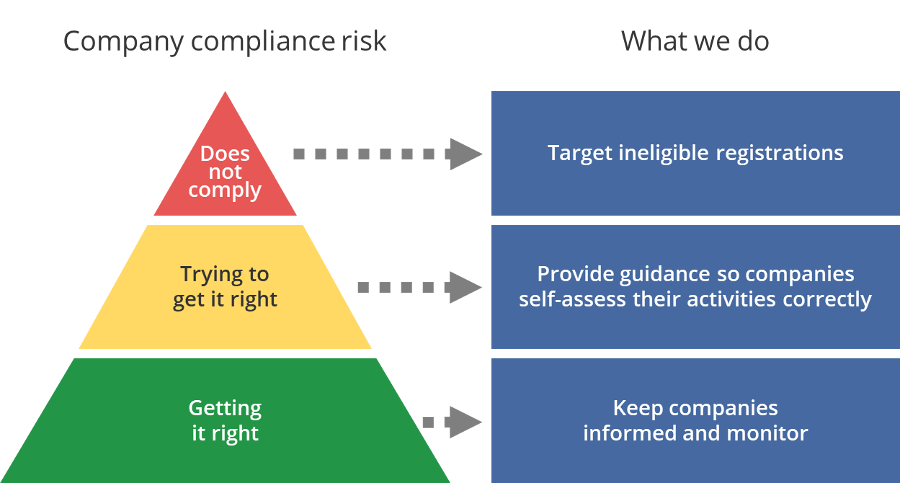

Companies need to accurately self-assess their activities and register them correctly to meet program objectives. We're responsible for ensuring the integrity of the program by checking the eligibility of activities.

Our integrity management strategy takes account of eligibility risks and company behaviour to categorise compliance risks.

Our integrity framework diagram shows how we engage with companies that meet program requirements. We provide more assistance to companies who need help to understand self-assessment processes. We direct the highest level of compliance to companies that fail to follow our guidance or don't comply with the legislation.

| Company compliance risk | Company behaviour | Our response |

|---|---|---|

| Does not comply |

Company considers the legislation and guidance but does not apply it as intended. Their R&D activities do not meet program requirements. |

We deter high-risk approaches with targeted compliance activity. |

| Trying to get it right | Company tries to follow the legislation and guidance. They may not understand it or apply it as intended. Some R&D activities may be eligible and some may not. | We provide tailored guidance to help companies self-assess. Ineligible activities may be varied or withdrawn. |

| Getting it right |

Company understands the legislation and program requirements. | We keep the company informed about their registration and monitor future applications. |

| Learning about the program | Company is new to the program. Some companies need assistance to understand the self-assessment process. | We provide guidance and support to help the company access the R&D Tax Incentive. |

Typical company journeys

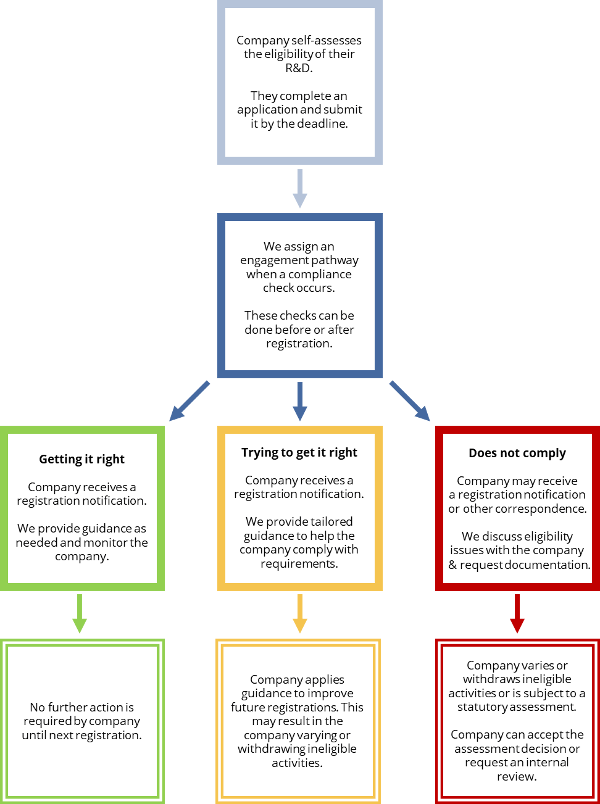

Before you apply for the R&D Tax Incentive, you must first decide if your R&D is eligible for the program. We've mapped the company journey to show the engagement pathways that can occur after you've submitted an application.

We recognise that most companies believe their activities are eligible. So we do reviews to determine the level of compliance risk shown by participating companies. We can do this before we register your activities or after you have received a registration notification letter. We tailor our education and engagement to respond to different levels of eligibility concerns.

We use the highest level of compliance action for companies that fail to follow our guidance. Or else for companies that don't follow the legislation. When we find a company or its R&D activities to be ineligible, it can't claim the tax offset.

Compliance reviews

Compliance reviews are undertaken both before and after registration. Getting a registration notification does not mean we've assessed the eligibility of your activities.

Not all R&D is eligible under the R&D Tax Incentive program. To accurately assess if your company and R&D is suitable for the program, please:

- Be informed. Consult our Guide to Interpretation and the other resources available. They'll help you assess the R&D activities you are conducting and plan to register.

- Keep records. Your records of the R&D activities and the expenditure you wish to claim provide the evidence for your registration. We may request them at any time.

- Contact us. Your case manager details are on the letters we send. Please contact them so we can answer your questions and provide guidance.

Read next

-

Learn about compliance reviews we conduct before and after registration.

How we check compliance