We use cookies to give you a better experience on our website. Learn more about how we use cookies and how you can select your preferences.

Right Click Capital – investing in businesses that have the potential to change the game

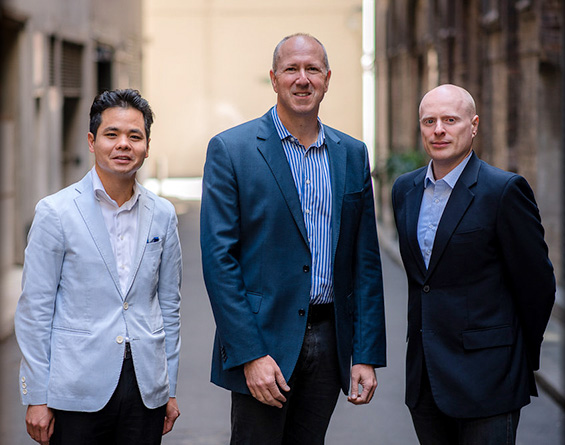

Right Click Capital partners (left to right): Benjamin Chong, Garry Visontay and Ari Klinger.

Right Click Capital investment fund manager Benjamin Chong says Australia’s venture capital arrangements are encouraging more people to consider investing in high potential early stage Australian companies.

Mr Chong, one of 3 partners at Australian venture capital firm Right Click Capital, says the 10% tax offset introduced in 2016 for people investing through early stage venture capital limited partnerships (ESVCLPs) is ‘sweetening’ investment opportunities and attracting new investors.

Investors can also receive capital gains tax free status for complying investments made through ESVCLPs, making it a very attractive asset class for investors.

‘The tax measures allow new investors to put their toe in the water on a very favourable basis.’

In 2016, Australia’s venture capital arrangements were also changed to allow venture capital funds to provide more support to innovative companies for longer.

The changes raised the investment ESVCLP funds can make, from $100 million to $200 million, and removed the requirement for funds to divest companies once their value exceeds $250 million.

‘Becoming a larger fund, making larger investments, allows us to better support more emerging companies,’ Mr Chong says. ‘And not having to divest companies that reach a value of $250 million means we are not forced to sell our stake in a business prematurely … it’s a very helpful measure.’

Encouraging investment in early stage companies

Right Click Capital backs Australian tech founders who have the passion and potential to change the game. Currently its portfolio comprises 25 companies, more than 80% of which were based in Australia when Right Click invested in them. Its investors include high net wealth individuals, family offices and superannuation funds.

‘We spend a lot of time with founders,’ Mr Chong says, ‘to understand what’s driving them and how they see the future – what they’re developing today and how that might fit into the future, and what intermediate steps will help them to get there.’

Right Click Capital’s financial backing and mentoring has helped several high profile Australian companies to go global. One of them is Swoop Aero, which manufactures and operates drones largely used for humanitarian needs. Founded in 2017 by a former RAAF pilot and a megatronics engineer, Swoop now operates on 6 continents, using world leading technology to remotely pilot drones around the world from its Melbourne base.

Mr Chong talked about some of the challenges in scaling a great idea and product. ‘How do you apply the learnings of people who understand megatronics and the criticality of Air Force operations? How have they gone about building this team of engineers and sales and support people? How have they been able to develop good relationships the NGOs on whose behalf the aircraft are used?’

Right Click invested in Swoop’s seed round and pre-Series A round. Swoop completed a $16 million Series B investment round in June 2022 to fund its continuing expansion. ‘They can’t produce the drones fast enough’, Mr Chong says. At the same time they’re also maintaining the aircraft and managing the flight operations that send vaccines, medications and critical supplies to meet humanitarian needs in places including Vanuatu, the Democratic Republic of Congo, Mozambique and remote parts of Australia.

‘For me it’s nice for a couple of reasons,’ says Mr Chong. ‘With companies like Swoop, it’s not just that we’re doing no harm but that we’re doing positive good.’

Features

- Right Click Capital’s ESVCLP fund has a current investment portfolio of 25 startup companies.

- Right Click Capital first invested in Australian drone manufacturer Swoop Aero at the seed stage, helping to get its innovative product and concept into the market for humanitarian drone aircraft and operations.

- Swoop Aero now operates its drones remotely on 6 continents.

How the Australian Government has helped

Australian Government venture capital programs work with private venture capital fund managers to provide capital and professional expertise to innovative Australian companies.

The Australian Government’s ESVCLP program provides tax concessions that help venture capital firms like Right Click Capital attract investors. ESVCLPs provide great benefits for startup companies, most significantly the capital necessary to get their business off the ground. Startup companies also benefit from the network the partnership brings, with access to other similar minded companies and to the experience investors bring.

‘If this program didn’t exist, the number of companies in Australia would be a lot lower,’ Mr Chong says.

Further information

Right Click Capital has assisted Swoop through its fund registered under the Australian Government’s Early Stage Venture Capital Limited Partnerships (ESVCLP) program.

-

Visit the Right Click Capital website.

Right Click Capital -

Find out more about Venture Capital programs.

Venture Capital